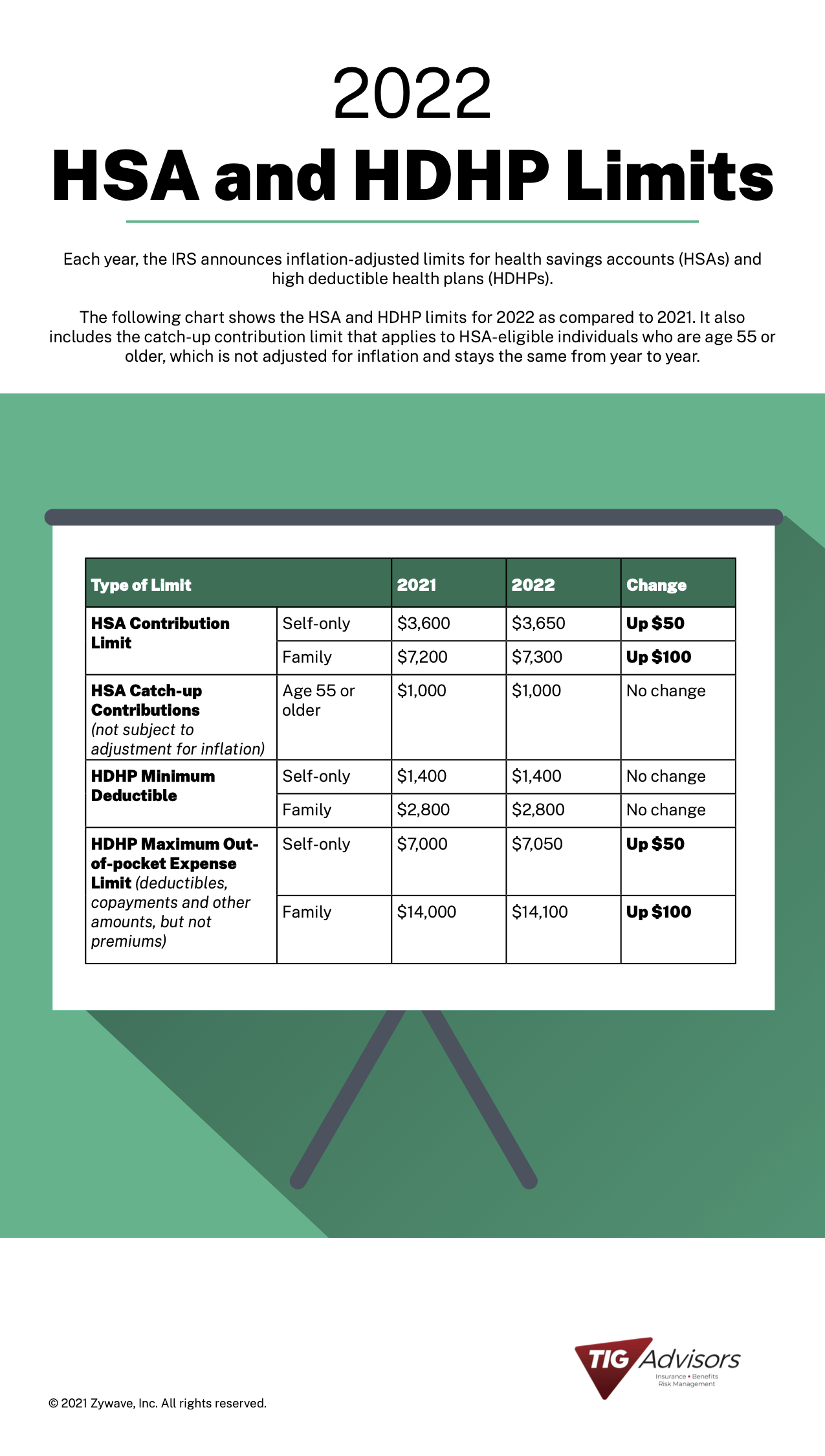

2022 HSA and HDHP Limits

Each year, the IRS announces inflation-adjusted limits for health savings accounts (HSAs) and high deductible health plans (HDHPs). The following chart shows the HSA and HDHP limits for 2022 as compared to 2021. It also includes the catch-up contribution limit that applies to HSA-eligible individuals who are age 55 or older, which is not adjusted for inflation and stays the same from year to year.

|

Type of Limit |

2021 |

2022 |

Change |

|

|

HSA Contribution Limit |

Self-only |

$3,600 |

$3,650 |

Up $50 |

|

Family |

$7,200 |

$7,300 |

Up $100 |

|

|

HSA Catch-up Contributions (not subject to adjustment for inflation) |

Age 55 or older |

$1,000 |

$1,000 |

No change |

|

HDHP Minimum Deductible |

Self-only |

$1,400 |

$1,400 |

No change |

|

Family |

$2,800 |

$2,800 |

No change |

|

|

HDHP Maximum Out-of-pocket Expense Limit (deductibles, copayments and other amounts, but not premiums) |

Self-only |

$7,000 |

$7,050 |

Up $50 |

|

Family |

$14,000 |

$14,100 |

Up $100 |

|